Farmers advised to cope with the situation by selling canola regularly rather than holding back waiting for higher prices

Canola price prospects are flat at best because of an abundance of U.S. soybean oil, says a grain market analyst.

John Duvenaud, publisher of the Wild Oats Grain Market Advisory, said a record 125 million tonne soybean crop in the United States and a huge crush program in that country will keep a lid on canola prices.

“The Americans are crushing for the meal and are dumping the oil,” he said.

“Soy meal keeps going up and soy oil keeps going down and that’s going to be a tough slog for the canola market to get past all those soy oil supplies.”

Read Also

Trump’s tariffs take their toll on U.S. producers

U.S. farmers say Trump’s tariffs have been devastating for growers in that country.

Rich Nelson, chief strategist with Allendale Inc., said U.S. crushers have been extremely busy in the wake of a short soybean crop in Argentina and the loss of the Chinese market for soybean seed.

“We definitely saw U.S. crush activity just go crazy,” he said.

Crush has been up nine to 15 percent over last year’s pace every month between February and July. March set a record for any previous month in any previous year.

“We’ve done fantastic activity here,” said Nelson.

The U.S. market is absorbing the bulk of the meal and oil, but oil exports are also on the rise.

“The only way we’re going to keep this up is by keeping price very, very competitive,” he said.

There is no shortage of canola either. Statistics Canada is forecasting a 19.2 million tonne crop, which would be the third largest in history. The U.S. Department of Agriculture believes it is about one million tonnes larger than that.

Duvenaud is advising his clients to keep their sales current by selling canola regularly rather than holding back waiting for higher prices.

Another bearish factor for canola is that it tends to be a crop that keeps getting bigger.

An analysis by Weber Commodities shows that the crop has grown by an average of 16.8 percent, or 2.16 million tonnes, between Statistics Canada’s first production estimate in August and its final report in the last dozen years.

It has gotten bigger in 11 of the last 12 years. The only exception is 2012-13, when it shrunk by 10 percent, or 1.5 million tonnes. That was the year plow winds blew canola swaths across the Prairies.

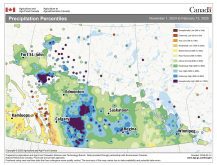

Duvenaud doesn’t believe the crop will grow by 2.16 million tonnes this year because growing conditions were less than ideal.

“After the middle of July it never really rained. The crops aren’t as good as they were a year ago,” he said.

Neither are the crops in the European Union and Australia.

Europe’s crop monitor is forecasting an average rapeseed yield of 51 bushels an acre, which is 13 percent below the five-year average.

The Australian Bureau of Agricultural and Resource Economics and Sciences is forecasting 2.79 million tonnes of canola production, which would be 24 percent smaller than the previous year.

“Those are positives, absolutely,” said Duvenaud.

“But the American soybean crop outweighs them.”

The smaller crop in the EU will be partially offset by bigger crops in the Black Sea region.

APK-Inform is forecasting 2.6 million tonnes of Ukrainian production in 2018-19, a 13 percent increase over the previous year. It would be second only to the 2.8 million tonnes harvested in 2008-09.

APK is forecasting 2.38 million tonnes of Ukrainian exports, most of which will make its way to the European Union.

Russian rapeseed production is forecast at a record 2.19 million tonnes, up 45 percent from the previous year.

APK is forecasting a record 350,000 tonnes of seed exports, a 59 percent increase from the previous year. China and Mongolia are two of Russia’s largest rapeseed customers.

Russia is also expected to ship out 530,000 tonnes of rapeseed oil, a 61 percent increase over the previous year.