Food inflation may prompt government to lift import restrictions, as well as concerns about the size of country’s pulse crop

Canada’s pea markets will transform in 2022-23, says an analyst.

“There is a lot of shifting going on here,” said Marlene Boersch, managing partner of Mercantile Consulting Venture.

The biggest question mark is what will happen with India this year?

Food price inflation is rampant in that country, which could cause India to rethink import restrictions that have kept Canadian peas out of that market for years.

Peas are still the cheapest pulse crop, so the government may decide it would be worthwhile to import the crop to help stem food price inflation.

Read Also

European wheat production makes big recovery

EU crop prospects are vastly improved, which could mean fewer canola and durum imports from Canada.

Indian consumers are familiar with using imported yellow peas to make chana dal. About a decade ago they were importing over one million tonnes of Canadian yellow peas per year.

“We know they can take an awful lot,” said Boersch.

“Potentially it could be a huge, big factor.”

India’s wheat production is much lower than initially anticipated due to excessively hot conditions. That weather likely affected pulse production as well, she said.

G. Chandrashekhar, senior editor of the Hindu Business Line, recently told the Global Pulse Confederation he has serious doubts about the official government estimate of 14 million tonnes of Indian chickpea production.

“I see the crop size at about 10 million tonnes,” he said in a June 20, 2022, GPC interview.

“And I think that as an outside limit of crop size it could be 11 million tonnes, certainly not more.”

Boersch said another bullish demand factor is the rapid appreciation of meat prices in Turkey and other countries, which will likely lead to an increase in pulse consumption in those markets.

The European Union has sanctions against Russian peas, which means there should be some opening for Canadian peas in that market.

“On the other hand, I would think that Russia will be trying to be very aggressive into places that have been receptive to their stuff, and Bangladesh is probably on top of that list,” said Boersch.

Canada has shipped very little to that market this year.

Estimates of Russian pea production range from 2.7 to 3.1 million tonnes, making it the second largest pea producer behind Canada.

Russia exported a record 1.2 million tonnes of peas in 2021, according to APK Inform.

Turkey was the top buyer followed by Bangladesh, Italy, Latvia and Spain. Sales to both Turkey and Bangladesh tripled in volume from the previous year.

Mercantile expects China to start buying Russian peas in 2022-23, which would adversely affect sales to Canada’s top market.

China and Russia recently signed a phytosanitary protocol for peas, although there are still a number of details to be worked out between the two countries.

Meanwhile, the supply of peas appears to be contracting around the world from earlier estimates.

Statistics Canada is now forecasting an 11.8 percent drop in Canadian pea plantings to 3.37 million acres, which is below its March estimate of 3.55 million acres.

Boersch said that drop seems a bit too dramatic. She had been forecasting a 10 percent decline.

“I think it’s down, (but) I’m not sure it’s quite that much,” she said.

Boersch is forecasting 3.4 million tonnes of production, which would be 48 percent higher than last year but well below the peak of 4.9 million tonnes in 2016.

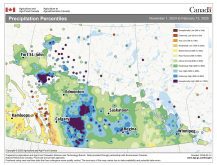

Crop conditions are not great in Manitoba but much improved in Saskatchewan and southern Alberta.

Farmers in the United States planted 1.02 million acres of peas, which is below the 1.09 million acres they intended to plant back in March.

Meanwhile, UkrAgroConsult is forecasting that Ukrainian farmers will harvest 250,000 tonnes of peas, which would be less than half of last year’s production.