Canola futures finished the week on an up note, supported by the weak loonie, rising soy oil and crude.

November canola closed at $510.20 per tonne, up $2.40 and January closed at $519.20, up $2.90.

For the week, November rose $8 and January climbed $8.70.

The most traded January contract rose 1.7 percent over the week.

ICE Futures Canada delisted its milling wheat, durum and barley contracts yesterday, putting the nail in the coffins for the three instruments that never attracted the trade’s attention. For a full story on the delisting, click here.

Read Also

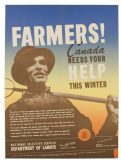

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

A lot of this week’s gains in canola were tied to the 1.25 cent decline in the Canadian dollar, which fell after comments from the Bank of Canada that led the market to reduce its expectation of another interest rate increase this year. Also, the U.S. dollar is generally rising against a number of world currencies as its economy performs better than expected.

CLICK HERE TO WATCH OUR WEEKLY VIDEO MARKETS ANALYSIS

But canola is also supported by strong exports and domestic crush. Reuters reported that there is talk in the industry about new export sales to China, partly because of improved crush margins in that country.

WEEKLY CRUSH

This week’s crush was 196,592 tonnes, up about five percent from the previous week and close to 89 percent of capacity, according to the Canadian Oilseed Processors Association.

The total crush to date is 2.07 million tonnes, down only a little from last year’s record pace of 2.12 million.

The weaker loonie should increase the profitability of the crush sector.

EXPORTS

The weekly canola export number from the Canadian Grain Commission was down from recent weeks, but the total canola exports to date, at 2.19 million tonnes exported, are still well up from 1.87 million last year.

DERAILMENT DELAYS

The rail-to-export system has generally been operating well this crop year but the wind storm Oct. 22 that contributed to the Canadian National Railway mainline derailment at Wainwright, Alta., made the line impassable for a couple of days, affecting outbound and inbound trains.

CN said it had initiated some work arounds, but delays were unavoidable. Spotting of cars for week 12 and 13 would be influenced by the disruption in flow.

CN notes that port terminals were fairly full and so there was a significant amount of grain on hand to fill nearby vessel requirements.

US GRAINS

The stronger U.S. dollar weighed against corn and wheat futures.

Soybeans and soy oil edged higher yoday.

For the week, wheat futures rose 0.2 percent, corn futures rose 1.1 percent and soybean futures dipped 0.3 percent.

Soy oil rose almost two percent on the week.

CHINA WHEAT

China today announced it would drop its floor price for wheat by 2.5 percent.

The crop for harvest in 2018 is already in the ground but a reduced price had been expected.

China wants to scale back wheat and corn production to address its surpluses and huge stockpiles. It wants to encourage soybean production to partly reduce the amount of soybeans it imports.

China has also started a big push into ethanol production to start to use up its corn and wheat stocks.

MEXICO

Mexico is exploring new sources for grain imports.

It has already arranged to buy 30,000 tonnes of wheat from Argentina and Agrimoney.com reports that Mexico is also looking at potential imports from Australia and Europe.

Mexico is the largest buyer of American wheat exports. As tensions rise between the U.S. and Mexico there is a political element to Mexico’s search for new suppliers, but also Argentina wheat costs less than American wheat.

Mexico bought about 875,000 tonnes of Canadian wheat last crop year, putting it in fifth position.

OUTSIDE MARKETS

Light crude oil nearby futures in New York were up $1.26 at US$53.90 per barrel.

In the afternoon, the Canadian dollar was trading around US77.96 cents, up from 77.80 cents the previous trading day. The U.S. dollar was C$1.2827.

The rally in crude oil and strong U.S. market lifted the TSX composite index to a record high.

It closed up 61.88 points, or 0.39 per cent, at 15,953.51. The previous record close was 15,922.37 reached in February.

Strong quarter results at tech powerhouses Amazon and Google caused the Nasdaq to soar.

The Dow Jones Industrial Average rose 31.92 points, or 0.14 percent, to 23,432.78, the S&P 500 gained 20.66 points, or 0.81 percent, to 2,581.06 and the Nasdaq Composite added 144.49 points, or 2.2 percent, to 6,701.26.

For the week, the TSX composite rose 0.6 percent, the Dow rose 0.5 percent, the S&P 500 gained 0.2 percent and the Nasdaq climbed 1.1 percent.

Winnipeg ICE Futures Canada dollars per tonne

Canola Nov 17 510.20s +2.40 +0.47%

Canola Jan 18 519.20s +2.90 +0.56%

Canola Mar 18 525.30s +2.80 +0.54%

Canola May 18 528.00s +3.10 +0.59%

Canola Jul 18 529.20s +3.20 +0.61%

ICE delisted the milling wheat, durum and barley contracts.

American crop prices in cents US/bushel, soybean meal in $US/short ton, soy oil in cents US/pound. Prices are displayed with fractions (2/8, 4/8, and 6/8) instead of decimals. -2 equals .25, -4 equals .50, -6 equals .75. The “s” means it is the settlement.

Chicago

Soybeans Nov 17 975-2s +4-0 +0.41%

Soybeans Jan 18 986-4s +4-0 +0.41%

Soybeans Mar 18 996-6s +3-6 +0.38%

Soybeans May 18 1006-0s +3-6 +0.37%

Soybeans Jul 18 1013-4s +3-4 +0.35%

Soybean Meal Dec 17 312.1s unch unch

Soybean Meal Jan 18 314.1s -0.1 -0.03%

Soybean Meal Mar 18 317.2s unch unch

Soybean Oil Dec 17 34.84s +0.34 +0.99%

Soybean Oil Jan 18 35.01s +0.35 +1.01%

Soybean Oil Mar 18 35.21s +0.33 +0.95%

Corn Dec 17 348-6s -1-6 -0.50%

Corn Mar 18 362-4s -2-0 -0.55%

Corn May 18 371-2s -2-0 -0.54%

Corn Jul 18 378-6s -1-6 -0.46%

Corn Sep 18 385-4s -1-6 -0.45%

Oats Dec 17 265-2s +2-6 +1.05%

Oats Mar 18 268-4s +3-0 +1.13%

Oats May 18 272-0s +3-4 +1.30%

Oats Jul 18 272-0s +5-4 +2.06%

Oats Sep 18 272-0s +5-4 +2.06%

Wheat Dec 17 427-2s -4-4 -1.04%

Wheat Mar 18 445-2s -5-0 -1.11%

Wheat May 18 459-2s -5-0 -1.08%

Wheat Jul 18 474-0s -4-4 -0.94%

Wheat Sep 18 490-0s -4-4 -0.91%

Minneapolis

Spring Wheat Dec 17 617-0s -3-4 -0.56%

Spring Wheat Mar 18 628-4s -4-0 -0.63%

Spring Wheat May 18 635-4s -3-6 -0.59%

Spring Wheat Jul 18 639-2s -3-4 -0.54%

Spring Wheat Sep 18 633-0s -4-2 -0.67%

Kansas City

Hard Red Wheat Dec 17 425-2s -3-0 -0.70%

Hard Red Wheat Mar 18 443-0s -3-0 -0.67%

Hard Red Wheat May 18 457-0s -3-2 -0.71%

Hard Red Wheat Jul 18 474-6s -3-6 -0.78%

Hard Red Wheat Sep 18 493-0s -4-0 -0.80%

Chicago livestock futures in US¢/pound, Pit trade

Live Cattle Oct 17 115.375s +1.225 +1.07%

Live Cattle Dec 17 120.825s +0.125 +0.10%

Live Cattle Feb 18 125.750s -0.350 -0.28%

Feeder Cattle Nov 17 156.475s -0.700 -0.45%

Feeder Cattle Jan 18 155.950s -0.150 -0.10%

Feeder Cattle Mar 18 153.000s -0.075 -0.05%

Lean Hogs Dec 17 64.450s -0.600 -0.92%

Lean Hogs Feb 18 70.250s -0.275 -0.39%

Lean Hogs Apr 18 74.250s -0.150 -0.20%