There should be robust demand for malt barley in 2018-19, say analysts.

“There will be good demand both domestically and (for) export,” said Rod Green, a barley broker with Central Ag Marketing Ltd.

Domestic maltsters contracted a large amount of new crop malt barley.

They also carried over a lot of old crop malt barley, so additional sales may take a while to materialize.

“They overbought, so domestic maltsters have lots of supply in the short-term,” he said.

Bruce Burnett, director of markets and weather with Glacier FarmMedia’s MarketsFarm, expects strong export sales from September to December.

Read Also

Grain farming’s hard times expected to continue

Rabobank says it will be two more years before North American grain farmers achieve break-even due to “monster” supplies and “sticky” crop input prices.

Scorching hot temperatures and dry weather in northern Europe will increase protein levels and reduce test weights and plump factors for the malt barley crop.

“Although maltsters will be able to use this barley, the amount available for export will certainly be reduced,” Burnett wrote in a recent newsletter.

The drought in eastern Australia will also restrict malt barley exports from that key competitor.

“Expect demand for malting barley from Canada to be strong,” said Burnett.

Green said typically one million tonnes is consumed domestically and another one million tonnes is destined for export.

He is forecasting an average yield of 68.7 bushels per acre on 6.5 million acres of barley and a total supply of 9.8 million tonnes, which is slightly higher than Agriculture Canada’s 9.6 million tonne estimate.

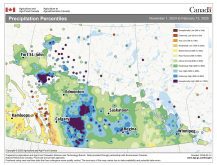

Growing conditions were similar to last year with a moisture deficit south of Highway No.1

“There is some production there, but the chance of very much of that being malt quality is less likely,” said Green.

Yields will be lower than last year in southern Alberta because last year’s crop was able to tap into the subsoil moisture that doesn’t exist this year.

The crop is in much better shape north of the Trans-Canada Highway and in the Peace region.

“That’s where the majority of the malt barley will come from,” he said.

Maltsters are in the process of establishing prices for the 2018-19 season. Green said prices will be higher than $5 per bushel, but he doesn’t know how much higher.

One limiting factor is another bin-busting U.S. corn crop. The U.S. Department of Agriculture is forecasting a record average yield of 178.4 bu. per acre.

“We’re going to see a lot of substitution of feed barley and corn in southern Alberta,” he said.

There are already “huge amounts” of corn being traded into southern Alberta, which will keep feed barley prices in check, and because malt barley is priced at a premium to feed barley, it will also cap malt barley prices.

“(U.S. corn) did play a fairly major role last year. This year it’s going to play an even bigger role,” said Green.