May 5 (Reuters) – Canadian fertilizer and farm retail dealer Agrium Inc on Tuesday reported a first-quarter profit that fell short of expectations, due in part to a late start to the U.S. spring farming season.

The company said it would boost its dividend by 12 percent to $3.50 per share annually.

Calgary, Alberta-based Agrium is North America’s biggest retail seller to farmers of inputs including seed, chemicals and fertilizer. Planting season got off to a slow start in the eastern and southern United States, but has recently accelerated, and the U.S. Department of Agriculture on Monday reported U.S. corn plantings were ahead of the five-year average pace.

Read Also

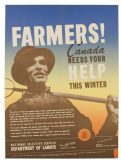

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

“All indications are that Agrium will deliver strong second-quarter results on solid crop input demand now that the spring application season is fully under way,” chief executive Chuck Magro said in a statement.

Agrium trimmed the top end of its 2015 profit forecast, to a range of $7.00 to $8.25 per share, from $7 to $8.50 per share previously. The company said the revision reflects pressure on global urea prices from higher Chinese exports.

Agrium’s U.S.-listed shares fell two percent after normal trading hours. They had earlier closed down 0.9 percent.

Net earnings for the first quarter rose to $14 million, or eight cents per share, from $3 million, or two cents per share, a year ago.

On an adjusted basis, earnings were $19 million, or 12 cents per share. Analysts on average expected Agrium to earn 33 cents a share in the first quarter, according to Thomson Reuters I/B/E/S.

Sales fell 7 percent to $2.9 billion, versus expectations for $3.145 billion.