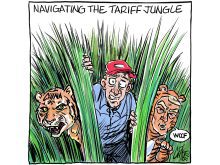

As if the U.S. tariff situation was not enough, China has announced a 100 per cent tariff on peas, canola oil and meal, which will begin on March 20.

Canadian canola farmers must feel that they have become a punching bag for their country’s trading partners. And I use the term partners loosely, as both China and the United States are certainly hitting Canadian canola producers hard.

Follow all our coverage of the tariffs situation here

Read Also

Russian wheat exports start to pick up the pace

Russia has had a slow start for its 2025-26 wheat export program, but the pace is starting to pick up and that is a bearish factor for prices.

U.S. tariffs have been delayed until April, but they will certainly impact not only canola, but also oil and meal when they are initiated. This will obviously have a dramatic impact on the Canadian canola crushing industry.

Canola crush to the end of January had been running at a record pace with a total of 5.93 million tonnes processed for the crop year to date. This is 415,602 tonnes ahead of last year at this time and is an all-time record.

The potential for slowing canola crush in the last half of the marketing year is a real possibility if the U.S. tariffs are imposed.

The Chinese tariffs, conversely, are in response to Canadian tariffs on electric vehicles and steel. Ironically, Canadian tariffs on China were part of a “fortress North America” strategy to protect the U.S. and Canadian EV industries.

It doesn’t feel very much like “fortress North America” after the U.S. announcements over the past month.

China has not imposed any duties on canola seed, but remember it is conducting an antidumping investigation into Canadian canola.

The market response to the Chinese tariffs was for nearby contracts to drop by the $40 per tonne daily trading limit. It is likely that Canadian canola will be subject to tariffs in the coming weeks.

Canadian canola exports to China have been setting a record pace this year with the crop year total to the end of January reaching 3.18 million tonnes.

Exports during January were strong at 336,700 tonnes. This was up significantly from December but was still the second lowest monthly total since the beginning of the crop year. The markets had been expecting a reduction in the pace of Chinese canola exports, but obviously the market hasn’t fully priced in Chinese tariffs.

The current situation in the canola market is the most challenging and volatile since the 1980s, and there is no easy answer on what to do with unsold canola stocks from this year’s crop.

The important point for marketing canola this year is that volatility will continue through 2025 and likely 2026. It means quick decision making will be needed through the marketing year. Buckle up because the ride in the canola markets will be a wild one.