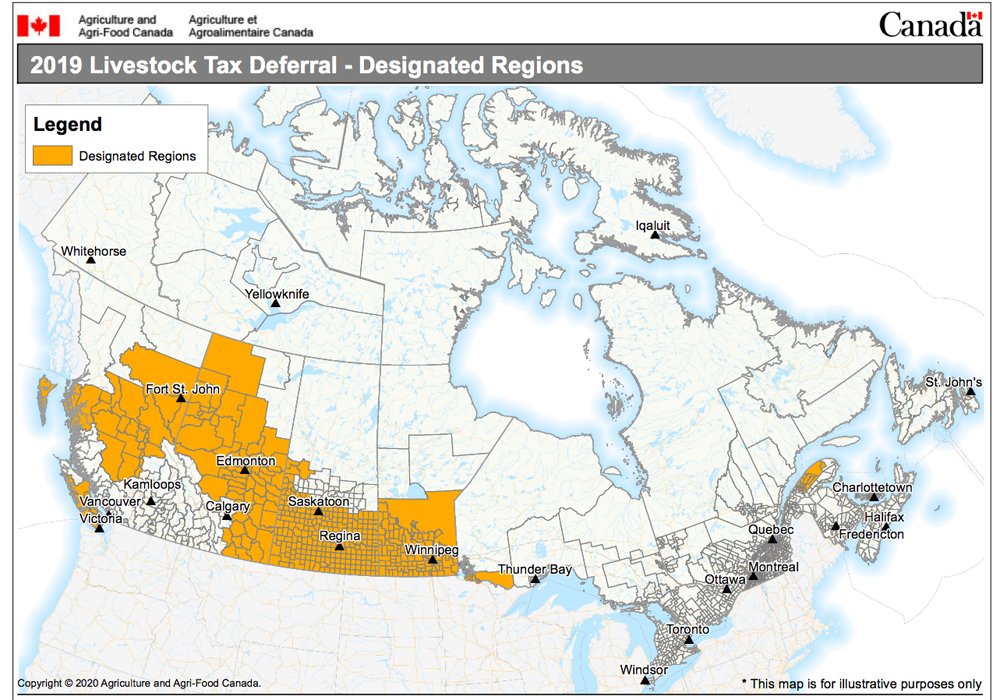

A final list of the designated regions eligible for livestock tax deferral was released Feb. 18 by Agriculture Canada.

The deferral was prompted by extreme weather conditions in various parts of the country last year, including drought, floods and excess moisture. It allows livestock producers to defer a portion of their 2019 sales of breeding stock until 2020.

The idea is that the extra cash can be used to buy breeding stock to replenish herds that had to be downsized because of adverse conditions. The cost of replacements would be offset by the deferred income, reducing the tax burden.

Read Also

Pakistan reopens its doors to Canadian canola

Pakistan reopens its doors to Canadian canola after a three-year hiatus.

An initial list of areas eligible for the deferral was issued July 22 for the four western provinces and Quebec.

“Ongoing analysis of drought conditions and excess moisture has indicated the need to expand the list of designated regions for 2019, with new regions identified for British Columbia, Alberta, Saskatchewan, Manitoba, Ontario, and Quebec,” Agriculture Canada said in a news release.

Regions eligible had forage shortfalls of 50 percent or more and were identified based on weather, climate and production data, the department said.

Producers who reduced their herds by at least 15 percent and less than 30 percent as a result of the adverse conditions identified by the department can defer 30 percent of the income from net sales. Those who reduced their herds by 30 percent or more can defer 90 percent of net sales.

Producers can request the deferral when they file their 2019 tax returns.

A map of the areas eligible includes a large portion of northern B.C., a stretch of northern Alberta and southward, encompassing an area east of Calgary to the Saskatchewan and U.S. borders, and most of southern Saskatchewan and Manitoba.

The map and a full list of eligible areas can be found here.

Contact barb.glen@producer.com