Rabobank has a grim long-term outlook for grain prices and farm profit margins but another leading economist doesn’t share that view.

Rabobank recently produced a report titled A Time to Evolve that forecasts a median U.S. farmgate corn price of US$3.60 to $3.80 per bushel between 2018 and 2024.

“Although the row crop economy appears to be nearing a low point, Rabobank analysis suggests that U.S. growers will continue to face low growth, low margins and thus low returns on invested capital over the next five years,” stated the report authored by Kenneth Zuckerberg and Sterling Liddell.

Read Also

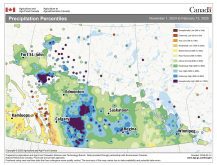

Volatile temperatures expected for this winter

DTN is forecasting a lot of temperature variability in the Canadian Prairies this winter. Precipitation should be close to average.

Arlan Suderman, chief commodities economist with INTL FCStone, chuckled when he heard the dismal price outlook.

The one thing he has learned in 40 years in the agriculture sector is that prices are cyclical.

“When you’re dealing with an extended period of low prices, that creates all kinds of new demand and discourages production and innovation,” said Suderman.

He believes grain markets are on the verge of demand exceeding production, a scenario already starting to play out in China.

In 2016, China backed away from offering handsome price subsidies to its corn growers, which has caused prices to fall and demand to rise.

In 2015-16 China had a 186-day supply of corn, or half of the world’s surplus stocks. The following year it dropped to 159 days and in 2017-18 it has fallen to 121 days of supply.

If the stockpile continues to dwindle at the same pace, it will be at 80 days next year, which is below China’s comfort level for reserves.

And some of that grain is not of acceptable quality, which is sending Chinese buyers to the United States and other places to source good quality grain.

“They’re coming to the United States and aggressively buying up all of our grain sorghum that they can find and starting to buy corn for delivery the new calendar year,” said Suderman.

China has also announced it is implementing a 10 percent ethanol mandate by 2020, which will likely require the country to import corn.

“I believe that they are committed to the policy because their huge pollution problem is putting a black mark on their reputation as a world economy,” he said.

China’s policy shifts will eventually lead to tightening global corn supplies and rising prices. It is only a matter of time, said Suderman.

Rabobank believes it will be a long time. In the meantime, farm profitability will largely depend on whether the land is owned or rented, with those who own land generating better returns.

Growers are going to need to “transform their businesses” to stay afloat.

Farmers are going to need to adopt on-farm technologies that optimize input usage and produce greater yields per input dollar, such as fertilizer measurement and management tools.

A second strategy is to acquire additional land to maximize economies of scale or to shift a portion of the operation into organic.

Investing in grain storage can provide growers with the flexibility they need to capture higher prices.

Farmers should also consider contracting directly with food processing or consumer packaged good companies.

A final option is to sell the farm or temporarily exit the business, but that is a last resort.