By Theopolis Waters

CHICAGO, July 9 (Reuters) – Chicago Mercantile Exchange live cattle futures on Wednesday closed lower, pressured by fund liquidation that erased short-covering advances early in the session, traders said.

More selling developed after the August and October contracts slipped below their respective 10-day moving averages of 152.31 and 155.03 cents, which triggered sell stops.

August live cattle finished 2.725 cents per pound lower at 150.800 cents, and October down 2.425 cents to 153.550 cents.

August led declines after funds rolled their positions by selling the August contract and buying deferred months.

Read Also

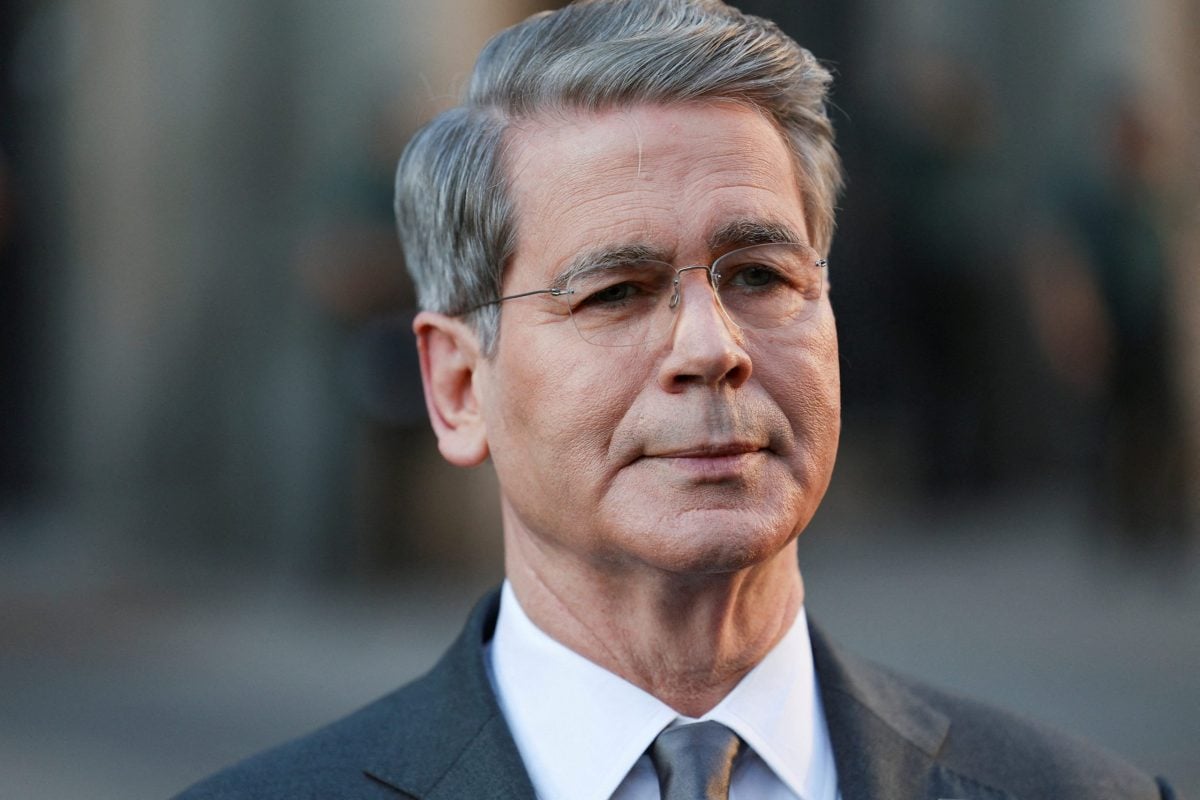

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

Market losses and thinner margins stirred talk of steady to lower prices for market-ready, or cash, cattle despite steadily rising wholesale beef values.

“We do have some bearish issues, which are valid. However, the trade is still not convinced that the bull market is done,” said Rich Nelson, chief strategist at Allendale Inc.

On Wednesday, a few cattle in Nebraska moved at $157 to $158 per hundredweight (cwt.), steady to $1 lower than a week ago, a feedlot source said. Cattle elsewhere in the state and the Plains were priced at $160, he added.

Last week, cash cattle in the U.S. Plains sold at an all-time high of $158 per cwt.

Wednesday afternoon’s wholesale price for Choice beef reached a record high of $250.57 per cwt., surpassing Tuesday’s top. Select slipped 36 cents to $242.26, based on U.S. Department of Agriculture data.

CME feeder cattle closed down sharply, pressured by the live cattle market’s retreat, sell stops and technical selling.

August closed down 2.300 cents per lb. at 213.600, and September 2.275 cents lower at 215.200 cents.

HOG FUTURES FINISH MIXED

CME July hog futures, which will expire on July 15, drew support from higher cash prices as the PED virus tightens near-term supplies, traders said.

“There has been some concern about cash hog prices,” said Nelson. “But as a whole, we continue to hear reports of packers scrambling to find numbers.”

USDA data showed the afternoon’s average hog price in the Iowa-Minnesota market up $2.03 per cwt. from Tuesday to $132.41, USDA said.

Fund rolling pressured August futures, but pushed up deep-deferred trading months.

July hogs closed 1.100 cents per lb. higher at 133.300. August ended down 0.250 cent to 129.600 cents.