Canola failed to cling to the coattails of the continuing soybean rally Monday, slipping through the day after an initial rise at the open.

Farmer selling and some softening of demand were mentioned as reasons canola fell on an up day for soybeans. The faster-than-usual prairie harvest is leading to an early harvest market.

November Winnipeg canola fell $4.20 to $633.40, while January fell $4 to $637.20. For both, that was a fall of about two-thirds of one percent.

Meanwhile, Chicago soybeans rallied a further 11 and a half cents per bushel for the November contract and 15 cents for the January.

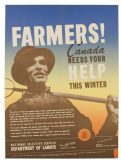

Read Also

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

That half-percent increase is only half the gain that exploded once the market opened Tuesday, with a big gap appearing on the charts and the fallback taking prices to a possible new level of support above the former high.

Soybean yields continue to appear critically low with little chance of recovery in the next days and weeks before harvest winds up.

Even signs of weakening soybean demand failed to knock back the market.

Canola wasn’t the only commodity to fail to hold onto the gains seen in soybeans. Wheat and corn futures contracts were mixed as the market digested the counterbalancing forces of poor crop results with demand rationing caused by the high prices.

Corn is still more than $8 per bu., while spring wheat remains comfortably above $9 per bu.

Contracts for prairie based crops such as spring wheat, oats and canola still have carry, revealing their better supplies than soybeans, while soybeans are still inverted and corn is essentially inverted, with little carry in the market.

Macro factors were balanced Tuesday, giving little additional impetus to the commodity markets. Data continues to make China look weak, but euro-types appear to be close to agreeing to American style quantitative easing.

Winnipeg (per tonne)

Canola Nov 12 $633.40, down $4.20 -0.66%

Canola Jan 13 $637.20, down $4.00 -0.62%

Canola Mar 13 $636.40, down $4.20 -0.66%

Canola May 13 $624.70, down $3.60 -0.57%

Milling Wheat Oct 12 $298.60, unchanged

Milling Wheat Dec 12 $306.10, unchanged

Milling Wheat Mar 13 $315.60, unchanged

Durum Wheat Oct 12 $300.60, unchanged

Durum Wheat Dec 12 $305.10, unchanged

Durum Wheat Mar 13 $311.70, unchanged

Barley Oct 12 $264.50, unchanged

Barley Dec 12 $269.50, unchanged

Barley Mar 13 $272.50, unchanged

Chicago (per bushel)

Soybeans (P) Sep 12 $17.7100, up 6.50 cents, up 0.37%

Soybeans (P) Nov 12 $17.6825, up 11.75

Soybeans (P) Jan 13 $17.6625, up 15.25

Soybeans (P) Mar 13 $17.1200, up 27.75

Corn (P) Sep 12 $8.0700, up 4.25 +0.53%

Corn (P) Dec 12 $8.0500, up 5.25 +0.66%

Corn (P) Mar 13 $8.0775, up 5.75 +0.72%

Oats (P) Sep 12 $3.8625, down 2.25 -0.58%

Oats (P) Dec 12 $3.9525, down 2.25

Oats (P) Mar 13 $3.9450, down 2.50 -0.63%

Minneapolis (per bushel)

Spring Wheat Sep 12 $9.2875, down 3.00 cents -0.32%

Spring Wheat Dec 12 $9.4875, up 0.50 +0.05%

Spring Wheat Mar 13 $9.5775, up 1.00 +0.10%

Spring Wheat May 13 $9.6450, up 1.25 +0.13%

The previous day’s best canola basis was $22.47 under the November contract according to ICE Futures Canada in Winnipeg.

Light crude oil nearby futures in New York dropped $1.17 at $95.30 US per barrel.

The Canadian dollar at noon was $1.0139 US, unchanged from the previous trading day. The U.S. dollar at noon was 98.63 cents Cdn.