July 27 (Reuters) – Bunge Ltd raised its full-year profit forecast on Wednesday, and posted a 15 percent jump in second-quarter 2022 adjusted profit, as the global farm commodities merchant benefited from higher demand and tighter supplies of commodity grain crops.

But the Missouri-based firm’s results fell short of Wall Street expectations for the reported quarter ended June 30.

Excluding items, Bunge earned US$2.97 per share, below analysts’ estimate of US$3.26 per share, according to Refinitiv data. And while the company’s second-quarter revenue climbed 16.5 percent to US$17.93 billion, it missed estimates of US$18.46 billion.

Read Also

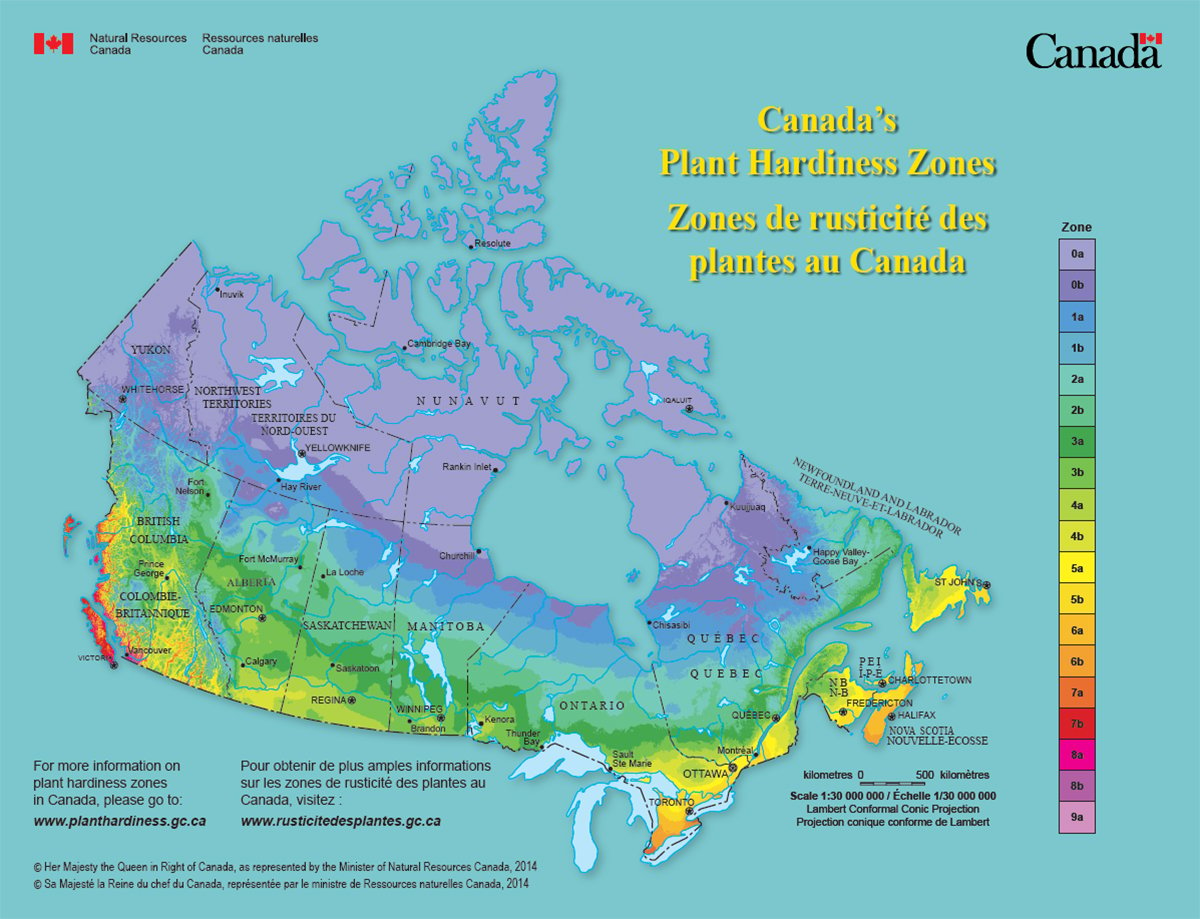

Canada’s plant hardiness zones receive update

The latest update to Canada’s plant hardiness zones and plant hardiness maps was released this summer.

Bunge’s results come at a time when global supply chains have snarled and strong demand for food and fuel have propelled inflation to the highest in decades.

Russia’s invasion of major corn and wheat exporter Ukraine has driven up demand for crops supply-chain middlemen like Bunge ship around the world. Rival Archer-Daniels-Midland also reported strong earnings on Tuesday.

But transportation and ongoing pandemic-related issues continue to be a drag on the grain sector overall.

Bunge’s agribusiness unit saw a boost from U.S. and Brazilian soy crush due to strong demand for meal and oil, it said, but its merchandising group was impacted by ocean freight issues, where rates have soared and ports have been log-jammed.

Its sugar and bioenergy segment enjoyed higher ethanol prices, but that boost was offset by “lower ethanol volumes and increased costs,” the company said in a statement.

Bunge said it now expects annual adjusted earnings of at least US$12 per share, compared with its previous forecast of at least US$11.50 per share.

Bunge also introduced a new earnings framework of about US$11 per share by the end of 2026; and approximately US$3.3 billion of “projected future investments” in growth capex and M&A, and US$1.25 billion of share buybacks through this period, Bunge said.