June 6 (Reuters) – Dry bulk shipper DryShips Inc raised “substantial doubt” about its ability to stay in business after it defaulted on three bank facilities, hit by a prolonged downturn in commodity prices and low charter rates.

The company’s shares fell as much as 26 percent to $1.75 in extended trading on Monday.

DryShips, which had total liabilities of $280 million as of March 31, said in a regulatory filing that it was in breach of financial covenants and has elected to suspend principal repayments and interest payments for the remaining bank facilities. (http://1.usa.gov/1tcW16D)

Read Also

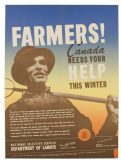

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

Shippers which transport commodities such as coal, iron ore and grain have been hurt by tepid demand, especially in China, and a surplus of vessels for hire.

The Baltic Exchange’s main Baltic Dry index has dropped 22 percent to $610 since the beginning of 2015. It fell as low as $290 this year.

The company had reported a near 98 pct fall in revenue for the quarter ended March 31 as time charter equivalent, the average daily revenue performance of a vessel on a per voyage basis fell more than 99 percent.

Up to Monday’s close, DryShips’ stock had fallen about 88 percent this year.