Canola futures hardly moved today and ended mixed, while over the week the March contract edged down only $1.60 per tonne.

That works out to a decline of only 0.35 percent, much better than the 5.8 percent decline in March soybeans.

The weaker Canadian dollar, investment fund buying and the tighter supply-demand situation in canola compared to soybeans kept canola fairly steady over the week.

Export demand so far this crop year has been solid and there was an uptick in canola crush in the latest week.

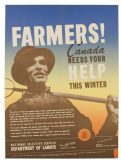

Read Also

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

The Canadian Oilseed Processors Association said members crushed 145,341 tonnes of canola in the week ending Jan. 14, up almost 14 percent from the week before.

That represented a capacity use just shy of 80 percent, only slightly less than the average to date.

Bruce Burnett of CWB believes year-end Canadian canola supply will fall below one million tonnes, whereas the December Agriculture Canada supply and demand outlook pegged ending stocks at 1.45 million tonnes.

Burnett was speaking at the CWB session during Crop Production Week in Saskatoon Friday.

Burnett expects that while soybean futures will struggle in the near term as the South American harvest looms and the U.S. dollar rises, canola cash prices could edge higher later this year as the loonie remains weak and as available canola stocks begin to tighten.

Commerzbank, a Germany-based international bank and financial services company, noted that European and Ukraine rapeseed production would likely be smaller in 2015-16. It cited Oil World’s forecast of a 20.4 million tonne rapeseed crop, down from 24 million in 2014. The ban on neonicotinoids in Europe could limit yields if insect damage worsens.

Ukraine’s winter seeded rapeseed crop, like its wheat crop, was stressed by dry weather going into dormancy.

Soybean futures dipped Friday, capping a week of significant decline, following the bearish USDA report Monday and prospects for a record South American harvest. The southern harvest might be a little less than expected because of recent dry weather, but will still be a record, said analyst Oil World.

Negative news today was that Chinese buyers canceled deals to buy 285,000 tonnes of soybeans from the U.S. for shipment in the current crop year.

March soymeal futures fell 6.6 percent on the week while March soy oil fell only 0.6 percent. There are expectations that U.S. crush will slow, leading to reduced production of soy oil.

Palm oil futures fell 1.6 percent this week.

Concerns about reduced availability because of monsoon flooding and the weaker local currency have supported palm in recent weeks, but this week, falling crude oil and worries about demand pressured the oilseed lower.

Reuters reported cargo surveyors said overseas sales of Malaysian palm products fell between 12 and 13 percent in the first half of January compared to December.

Corn futures rose 1.8 percent today on bargain buying, short covering and good weekly export business. On the week, nearby corn fell 3.5 percent.

Support today came from a general modest rebound in commodities. Some analysts think that oil prices might have bottomed out.

Also U.S. consumer sentiment hit its highest in 11 years in January, while factory output rose last month, indicating the U.S. economy is still steaming ahead.

ICE Futures barley again showed it was not dead with another 25 trades in Marh and May, raising the March contract to $195 a tonne, up $4 today.

ICE Futures milling wheat was adjusted up $1 but there was no trade or open interest.

Chicago wheat closed down for an eighth straight day but the Minneapolis hard red spring contract and Kansas hard red winter wheat were a little higher.

March Chicago wheat fell 5.8 percent this week while Kansas fell 4.2 percent. Minneapolis was down only three percent, reflecting the relatively stronger world demand for quality, high protein wheat this year.

Burnett of the CWB said he expects Canadian basis levels for quality wheat should improve over the coming months.

He also said durum prices in 2015-16 should remain attractive even with an expected 18 percent increase in seeded area in Canada.

Wheat futures for new crop will likely be about steady, but much depends on the wheat crop in the Black Sea region, he said.

Burnett expects the crop there to be about 10 million tonnes less than last year due to the dry fall when the crop was seeded. While dry in November, the Russian crop generally got above normal snowfall in December and that should help protect it, Burnett said.

Weekly updates from the USDA also say a moderate to deep snowpack of five to 40 centimetres are protecting dormant winter wheat in Russia. Northern Ukraine had less snow.

However, Twitter posts today by @AgronomyUkraine, a western agronomist with business in the Black Sea region, show fields in western Russia with little snow cover, inadequate protection if temperatures fell to -20C.

Turn to the Jan. 22 issue of the Western Producer and Producer.com for full coverage of Crop Production Week.

Light crude oil nearby futures in New York rose $2.44 to US$48.69 per barrel.

The Canadian dollar at noon was US83.43 cents, down from 83.81 cents the previous trading day. The U.S. dollar at noon was C$1.1986.

Data on U.S. inflation today showed a decline of 0.4 percent in December.

That caused many traders to believe that the U.S. Federal Reserve will not increase interest rates in June as was expected.

In early tallies —

The Toronto Stock Exchange’s S&P/TSX composite index closed up 267.59 points, or 1.91 percent, at 14,309.41.

The Dow Jones industrial average rose 190.8 points, or 1.1 percent, to 17,511.51.

The S&P 500 gained 26.7 points, or 1.34 percent, to 2,019.37.

The Nasdaq Composite added 63.56 points, or 1.39 percent, to 4,634.38.

For the week, the TSX was down 0.52 percent, the Dow was down 1.3 percent, the S&P 500 lost 1.2 percent and the Nasdaq fell 1.5 percent.

Winnipeg ICE Futures Canada dollars per tonne

Canola Mar 2015 450.60 -0.80 -0.18%

Canola May 2015 446.40 +0.50 +0.11%

Canola Jul 2015 440.60 +1.20 +0.27%

Canola Nov 2015 426.60 +1.40 +0.33%

Canola Jan 2016 429.00 +0.70 +0.16%

Milling Wheat Mar 2015 216.00 +1.00 +0.47%

Milling Wheat May 2015 219.00 +1.00 +0.46%

Milling Wheat Jul 2015 221.00 +1.00 +0.45%

Durum Wheat Mar 2015 361.00 unch 0.00%

Durum Wheat May 2015 351.00 unch 0.00%

Durum Wheat Jul 2015 341.00 unch 0.00%

Barley Mar 2015 195.00 +4.00 +2.09%

Barley May 2015 197.00 +4.00 +2.07%

Barley Jul 2015 199.00 +4.00 +2.05%

American crop prices in cents US/bushel, soybean meal in $US/short ton, soy oil in cents US/pound

Chicago

Soybeans Mar 2015 991.75 +0.75 +0.08%

Soybeans May 2015 997.5 +0.25 +0.03%

Soybeans Jul 2015 1003 -0.25 -0.02%

Soybeans Aug 2015 1002.5 -0.25 -0.02%

Soybeans Sep 2015 987.25 -1 -0.10%

Soybeans Nov 2015 975.25 -1.25 -0.13%

Soybean Meal Mar 2015 326.2 -0.5 -0.15%

Soybean Meal May 2015 320.5 -1.7 -0.53%

Soybean Meal Jul 2015 320.7 -1.7 -0.53%

Soybean Oil Mar 2015 33.39 +0.4 +1.21%

Soybean Oil May 2015 33.52 +0.39 +1.18%

Soybean Oil Jul 2015 33.69 +0.39 +1.17%

Corn Mar 2015 387 +7 +1.84%

Corn May 2015 394.25 +7 +1.81%

Corn Jul 2015 401 +7.5 +1.91%

Corn Sep 2015 406.75 +7.25 +1.81%

Corn Dec 2015 414.75 +7.25 +1.78%

Oats Mar 2015 288.75 +7 +2.48%

Oats May 2015 292 +7 +2.46%

Oats Jul 2015 296.75 +7 +2.42%

Oats Sep 2015 298.5 +6.75 +2.31%

Oats Dec 2015 296 +5 +1.72%

Wheat Mar 2015 532.75 unch 0.00%

Wheat May 2015 534.75 -1 -0.19%

Wheat Jul 2015 538.25 -1.75 -0.32%

Wheat Sep 2015 546 -1.5 -0.27%

Wheat Dec 2015 557.75 -1.5 -0.27%

Minneapolis

Spring Wheat Mar 2015 584.5 +3.5 +0.60%

Spring Wheat May 2015 590.75 +2.5 +0.42%

Spring Wheat Jul 2015 598.75 +2.25 +0.38%

Spring Wheat Sep 2015 605.75 +2 +0.33%

Spring Wheat Dec 2015 615 +1 +0.16%

Kansas City

Hard Red Wheat Mar 2015 577 +4 +0.70%

Hard Red Wheat May 2015 579.5 +3.5 +0.61%

Hard Red Wheat Jul 2015 582.75 +2.25 +0.39%

Hard Red Wheat Sep 2015 593.75 +2.25 +0.38%

Hard Red Wheat Dec 2015 607.5 +2 +0.33%