The housing crisis is a big deal in some parts of Canada, particularly large urban centres such as Vancouver and Toronto.

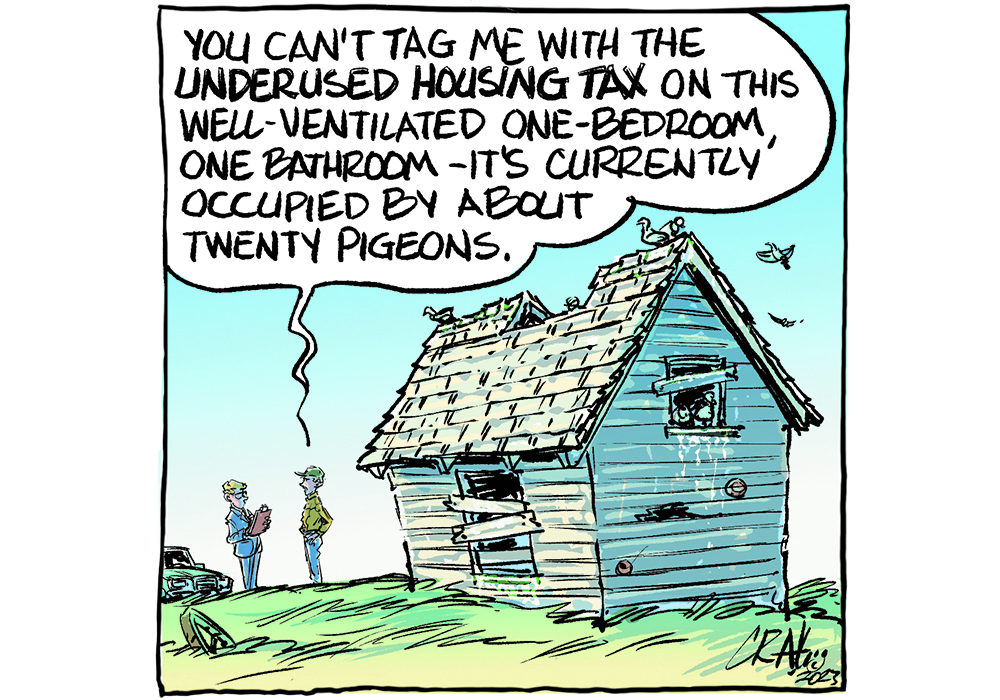

Part of the problem is foreign corporations that own houses but allow them to sit empty for much of the year. The federal government responded to that phenomenon last year by bringing in an Underused Housing Tax. It requires corporations to file returns for every one of their residential properties, through which they are assessed an annual one percent tax.

Problem solved, one might say.

Read Also

Don’t undermine the backbone of agriculture

Agriculture Canada and the dedicated public servants who work every day to support Canadian agriculture are a crucial pillar of the sector and they need support — not austerity.

Not so fast.

Canadian citizens and permanent residents are exempt from the tax but many corporations are not. The authors of this legislation likely didn’t consider that many of Canada’s family farms have incorporated over the years and now find themselves under a cloud cast by the Underused Housing Tax.

Farm incorporation is often done for tax purposes, for succession planning or to make certain administrative processes easier, such as applications for disaster financial assistance.

Many such incorporated farms own houses to accommodate seasonal workers and those houses are often vacant for part of the year.

Although residential properties owned by farm corporations are exempt from the tax, those corporations must still file a return. That costs time and money — and even more time and money if it’s necessary to apply for an exemption.

The tax doesn’t apply to bunkhouses and mobile homes, but it does apply to higher quality housing. And given recent emphasis on housing options for temporary workers, the tax filing requirement is one more impediment when it comes to improving the quality of accommodations.

Failure to file a UHT return can result in fines of $5,000 for individuals and $10,000 for corporations and partnerships for every residential property they own.

Numerous agricultural groups, including the Canadian Federation of Agriculture, Keystone Agricultural Producers, the Canadian Canola Growers Association, the Canadian Cattle Association, the National Cattle Feeders Association, the BC Agriculture Council, Fruit and Vegetable Growers of Canada, Ontario Greenhouse Vegetable Growers and the Canadian Ornamental Horticulture Alliance, have asked the federal government, through various channels, to issue a blanket exemption to farmers so they don’t have to file a return if they don’t have to pay the tax.

This is a reasonable request that should be granted. Farming is hard enough without the government adding unnecessary financial and administrative burdens.

On a larger scale, this issue shines a light on the more general issue of housing availability and affordability in Canada and whether rural regions can play a role in finding solutions.

Most of the housing debate is focused on large cities, but there may be merit in considering how to tap the potential of unused housing inventory in rural areas — assuming those who need homes are willing to live in those rural areas.

Farm consolidation and acquisition of smaller farms by larger operations often involves not only the transfer of farmland, but also houses. In some cases, these houses are torn down. In others, farmers try to rent them out but eventually tire of the headaches involved in being a landlord. An enterprising few will subdivide the house from the farmland and sell it.

What’s needed in general are incentives that make it easier for rural landowners to put vacant housing back into action.