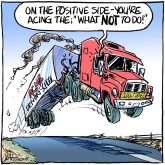

Nearly drowned out in all the farm group cheering that U.S. agricultural exports hit a record high US$196 billion last year was the inarguable fact that U.S. ag imports also hit a record-high $199 billion, or $3 billion more than ag exports.

That’s right, sports fans: during its biggest ag export year ever — when the value of American ag exports grew an astonishing $19.5 billion, or 11 percent, over 2021 — the value of U.S. ag imports grew by $28 billion, or 16 percent.

All that farm and food outflow and even more farm and food inflow is a hallmark of ever-changing global markets. Caught in that change is America’s fading dominance of world ag markets, markets that yielded a $17 billion surplus as recently as 2017.

Read Also

Higher farmland taxes for investors could solve two problems

The highest education and health care land tax would be for landlords, including investment companies, with no family ties to the land.

Now, however, it’s ag trade deficits, and none are going away anytime soon.

On Feb. 23, the U.S. Department of Agriculture estimated that the fiscal year 2023 U.S. ag trade deficit will balloon to $14.5 billion as American ag exports fall to $184.5 billion and ag imports remain at $199 billion.

If accurate (the trade numbers will be updated May 31), two eye-watering facts leap out. First, 2023 will post the largest ag trade deficit since at least 1959 and, second, 2023’s forecast means U.S. ag will have run trade deficits in four of the last five years.

Part of the U.S. shift to trade deficits swings on 2022’s strong commodity prices — tied to the Ukrainian-Russian war and global weather woes — and the export slowdown those steep, volatile prices caused global buyers.

For example, the American Farm Bureau Federation noted in a recent market intelligence report, “export value across all products (in 2022) increased by 11 percent year-over-year, but export volume actually declined by six percent.”

Still, that same AFBF analysis showed that “in 2022, U.S. exports remained concentrated in the top six markets. Sixty-seven percent of U.S. ag exports were to China ($38.2 billion), Mexico ($28.5 billion), Canada ($28.3 billion), Japan ($14.6 billion), EU27 ($12.3 billion) and South Korea ($9.5 billion).”

Like trade itself, however, those big players aren’t static. That’s especially true for China, our biggest, richest ag customer, suggested a recent article by the Council on Foreign Relations.

Even while “China ranks first globally in producing cereals such as corn, wheat, and rice, fruit, vegetables, meat, poultry, eggs, and fishery products,” CFR explained, it will continue to import ag commodities like soybeans whose “cost to grow… in China is 1.3 times than it is in the United States, and the yield is 60 percent less.”

Which is exactly what happened in 2022. China’s imports of U.S. soybeans were up eight percent by volume last year but its corn import volumes dropped 16 percent and wheat fell 13 percent.

That may become a trend, foresees CFR, as China seeks “to diversify its import sources…. In 2021, Brazil replaced the United States as China’s largest agricultural supplier, providing 20 percent of China’s agricultural imports.”

Other observers agree.

In a cold-eyed analysis of recent trade patterns between China and the U.S., the Peterson Institute for International Economics said the die was cast when “U.S. exports to China… cratered during President Donald Trump’s trade war of 2018-19” and now “are continuing to suffer.”

Farmers and policy makers should take heed because the Peterson Institute is not some lefty anti-trade hothouse. It is, in fact, the opposite; one columnist called it the “locker room of Team Globalization and Free Trade cheering squad.”

But this cheerleader can find no good news in the trading relationship that, in 2020, signed a “Phase One” deal that committed China to buy an additional $200 billion of U.S. goods and services (that)… in the end, China bought none of the extra $200 billion….”

Today’s facts and tomorrow’s forecasts suggest ag trade deficits, not surpluses, may be the new normal.

Alan Guebert is a commentator from Illinois.