Central banks reduce the cost of borrowing as inflation eases, making it easier to take out a loan and expand operations

Glacier FarmMedia – High interest rates are the hammer used by central banks to temper inflation, and many are now using the claw side of the tool to ease the higher rates of the past few years.

The Bank of Canada cut its benchmark overnight rate by 50 basis points on Dec. 12, taking it to 3.25 per cent. The accompanying statement suggests more rate cuts are coming but likely at a more gradual pace.

The overnight rate has declined from a nearby high of five per cent in June but remains far away from the pandemic low of 0.25 per cent and the pre-pandemic level of 1.75 per cent. Anywhere from 2.25 to 3.25 per cent is typically considered neutral for the Canadian economy, neither restricting nor stimulating growth.

Read Also

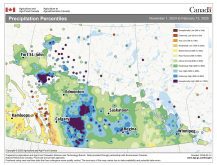

Volatile temperatures expected for this winter

DTN is forecasting a lot of temperature variability in the Canadian Prairies this winter. Precipitation should be close to average.

Canadian policymakers are looking to ride the fine line of encouraging economic growth while tamping down inflation, all under the uncertain threat of tariffs under incoming U.S. President Donald Trump.

The U.S. has also cut rates, but at a slower pace, and the interest rate spread between the two countries is at its widest since 1997. That accounts for some of the latest weakness in the Canadian dollar, which neared 70 U.S. cents in mid-December.

Lower interest rates are generally beneficial for agricultural markets, making it easier to take out a loan and expand operations. With cheaper operating costs and reduced pressure on operating lines of credit, farmers can focus more attention on upgrading their operations.

Costs of storing grain also go down as interest rates decline. In addition, weakness in the Canadian dollar makes Canadian exports more attractive for international buyers.

The consensus among most financial analysts is that the loonie will remain weak, with more rate cuts from the Bank of Canada. While that should be supportive for grain prices, it is worth remembering that there are unintended consequences when every problem is looked at like a nail.

Higher grain prices are offset by increased import costs for items such as machinery and fertilizer. Higher fuel prices and reduced purchasing power are other consequences.