Canada’s performance as a beef exporter in the last decade has been

impressive.

Canada is the third largest beef exporter in the world behind the

Americans and Australians. In 2001, Canada exported 59 percent of its

production either as beef or live animals to the United States, Asia

and Mexico.

Producing more than 1.575 billion kilograms of live cattle and beef

products, total sales are worth more than $3 billion annually, said

Canfax, a beef market analysis firm.

Read Also

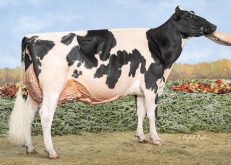

Saskatchewan dairy farm breeds international champion

A Saskatchewan bred cow made history at the 2025 World Dairy Expo in Madison, Wisconsin, when she was named grand champion in the five-year-old Holstein class.

Domestically, annual consumption remains flat at about 22 kg per capita

but demand has actually improved as Canadians are willing to pay more

for most cuts.

There are several reasons cited for why Canada, with one percent of the

world’s cattle population, is making such a showing.

Trade liberalization, improving incomes among beef eating nations and

dogged determination to give customers what they want all contributed

to the expanding export portfolio.

“NAFTA (North American Free Trade Agreement) opened up the door for

tremendous free trade access to Mexico,” said Dennis Laycraft,

executive vice-president of the Canadian Cattlemen’s Association.

Added Ted Haney of the Canada Beef Export Federation: “It has been our

industry’s adherence to serving our customers with product

differentiation.”

Figuring out this complex international business induced the beef

industry to form a global marketing strategy among Canadian producers

and processors who both wanted a place on the world stage. Starting in

2001, a broad industry-based committee has set realistic growth

opportunities over the next decade.

This not only includes selling more beef but capturing more money for

each carcass offered.

The domestic market is under the microscope to further decrease its

dependence on the American market where 73 percent of Canada’s exports

are consumed.

Canadian consumption is not expected to grow. However, considering

normal population growth in the next 10 years, Canada must produce 10

percent more beef to fill domestic needs.

Overall, Laycraft calculates 18 percent more production is required to

fill domestic and export markets in 2012. That means another 170,000

tonnes of beef are needed.

The strategy foresees a modest decline in sales to the U.S., with that

beef being redirected to Mexico and Asia. Ultimately the plan is to see

about half consumed domestically and the rest exported.

“This strategy would bring our markets into equilibrium,” said

Laycraft.

Canada has worked hard at image building in Asia through the formation

of the beef export federation in 1989.

Exporters received an early lesson in humility when they first

seriously pursued new markets. The made-in-Canada product did not suit

Asian specifications or palates.

Once they understood what these new customers wanted, beef processors

stopped grumbled about fussiness over marbling, trim requirements,

size, shape or packaging of cuts. By giving Asians what they wanted,

profit followed.

“Prices more than compensated for the yield loss. It pays for some of

your trouble,” said Haney.

Overall, Canada shipped about 114,376 tonnes in 2001 to Asian customers

and Mexico versus 13,935 tonnes in 1991.

Canada was one of the few exporting nations to survive two shattering

events last September.

The first happened Sept. 10 when bovine spongiform encephalopathy was

diagnosed in a Japanese dairy cow. Sales plummeted as people shied away

eating beef for fear of acquiring new variant Creutzfeld-Jakob disease,

which is believed to be caused by BSE.

The next day, terrorists attacked the U.S., sending markets into a

recessionary spiral.

As a small exporter with a lower dollar, Asian sales did not plummet to

the same depths experienced by the Americans.

Japan may remain sluggish this year but “the party is on in Korea,”

said Haney.

The South Korean economy is recovering, tariffs are dropping and new

beef buying programs are in place. Exports should reach 18,000 tonnes

in 2002 compared to 9,330 tonnes in 2001.

China is an unknown.

The Americans claim China as their top trade target for this century,

but Canada prefers to pursue the same market patiently, said Ben

Thorlakson, chair of the export federation and past-president of the

cattlemen’s association.

“The Chinese market is going to be a very slow developing market,”

agreed Laycraft.

China has one of the largest cattle herds in the world but many are

used as draft animals and the infrastructure for processing and

transportation is underdeveloped.

Projections suggest China could ultimately accept about 300,000 tonnes

annually. Ten percent of that market for Canada would be 30,000 tonnes

annually compared to the 1,425 tonnes sold there in 2001.

When China joined the World Trade Organization, beef tariffs dropped to

25 percent and are going to drop to 12 percent in 2004.

Mexico turned out to be a dark horse for Canada.

“A lot of things came together at the right time. It was the law of

unexpected consequences,” said Laycraft.

An American ranchers’ group attempted an anti-dumping case against

Mexico. Mexico retaliated and successfully imposed a countervail

against some American packers and kept them out of the export loop.

Canada was waiting and has since built a solid and amiable relationship

with Mexico.

The Mexicans bought products that were not widely used in Canada like

tongues, diaphragms and skirt muscles.

Full trade liberalization in Mexico starts in January 2003 when all

tariffs end.

Last year Canada shipped 69,900 tonnes of beef to Mexico and projects

more than 70,000 tonnes will go out this year.

“They like the opportunity of sourcing beef from a different source

than the United States,” said Thorlakson. “Wage levels are not as high

but the cost of living is not as high either so the net result is these

people are prosperous and they are beef eaters.”

Faint hope exists for the European Union opening its markets.

South America could be a formidable competitor if it solved problems

with animal diseases and political instability.

“South America is just teeming with potential but Brazil still

struggles with foot-and-mouth disease status,” said Laycraft. He sees

their grass-fed beef as a greater threat to Australia and New Zealand.

Overall, the U.S. is still the major buyer, but its threats of trade

disputes leave Canada in a state of anxiety over the next challenge.

Country-of-origin labelling legislation recently included in the U.S.

Farm Bill has Canada scrambling to find creative ways to hold its

American market.

The new rules for mandatory labels could come into effect in September

2004, just before the next American election. Members of Congress are

not likely to reverse this legislation at a critical time in their

political lives, said Thorlakson.

Canadians have argued the legislation breaks international trade rules

and could severely disrupt businesses.

One concept to preserve Canada’s sales to the U.S. is the development

of branded beef products. Marketing concepts like Alberta Beef,

Canadian Certified Angus Beef, Sterling Silver and Atlantic Tender Beef

may build customer loyalty in spite of this latest trade barrier.

Country-of origin labelling is a part of doing business in Asia and can

actually be used as a promotional tool where Canada has a good

reputation for wholesome foods and a clean environment. Yet deeply

ingrained nationalism in all markets must be appreciated because people

believe homegrown is better.

“Imported beef will never receive a price premium against domestic

beef,” said Haney.

Canada has achieved price parity with U.S. beef in Japan. It was

formerly discounted 15 percent below the American product.

The other major trade threat is foreign animal disease.

“There are two markets in the world. Those free of foot-and-mouth and

those which have the disease or are vaccinating for it,” said Laycraft.

More than $30 billion has been spent to mitigate damage from animal

diseases in Europe and Asia in the last decade. The two most calamitous

diseases were foot-and-mouth and BSE, he said.