KANSAS CITY, Mo. (Reuters) – Monsanto reported a 45 percent drop in quarterly net income as the global seed leader’s Roundup herbicide business continued to struggle, sending its shares down as much as 4.3 percent.Company officials, who called 2010 a “challenging year,” said while they saw a five percent jump in net sales of seeds and genomics, net sales of Roundup and other glyphosate-based herbicides fell 56 percent.Roundup was once a key product for Monsanto, and it has continued to generate sales in the face of generic competition, in part because of Monsanto’s development of Roundup Ready crops.But as problems with weed resistance have mounted and generic competition has pressured prices, Monsanto has seen its herbicide revenue slide.It is also dealing with problems on the seed side as its new Roundup Ready 2 Yield soybeans have not performed as well as expected and farmers have complained about high prices.“The operating results were weaker than we were expecting on the corn and soybean side as well as on the glyphosate side,” said Jefferies and Company analyst Laurence Alexander.He said glyphosate price declines were a key pressure point for Monsanto as retail prices for glyphosate are running around $8 US to $11 per gallon, down from a peak of above $35 two years ago.Monsanto’s net income for the third quarter ending on May 31 fell to $384 million, or 70 cents a share, from $694 million, or $1.25 a share, a year earlier.Ongoing earnings of 81 cents a share slightly beat analysts’ expectations of 79 cents, according to Thomson Reuters.Revenue fell to $2.96 billion from $3.16 billion, missing analysts’ forecasts of $3.17 billion.Monsanto said last month that it was revamping its business in glyphosate to price its products closer to generic offerings and streamline its own product offerings. The company is also accelerating payment on certain distributor and retailer incentives to close out those programs.Monsanto has also acknowledged a need to make changes in the seed business amid industry complaints that prices are too high and that farmers need more product alternatives.The company has recently rolled out new pricing to its seed licencees and in some cases is reducing premiums farmers must pay by half.The changes come as the U.S. Department of Justice is scrutinizing Monsanto’s actions in the U.S. seed industry in response to allegations by competitors and others of unfair pricing and antitrust violations. Monsanto has denied these allegations.“We’ve made some real changes to our portfolio and business approach, and the positive feedback I’m hearing from our customers tells me we are on the right track,” Monsanto chair Hugh Grant said in a statement.Monsanto expects cash flow of $400 million to $500 million for fiscal year 2010, with net cash of $1.3 billion to $1.5 billion provided by operating activities.Monsanto also repeated its fiscal-year earnings forecast of $2.40 to $2.60 per share on an ongoing basis and $2.15 to $2.41 on an as-reported basis.Looking to next year, Monsanto said it expects to achieve its forecasted mid-teens earnings growth in 2011, and that growth will come almost exclusively from the seeds and genomics segment where gross profit is expected to increase more than 10 percent.Research and development expenditures are expected to increase over 2010 and the agricultural productivity segment is expected to earn gross profits of $550 million to $600 million in 2011.

Read Also

Alberta’s beets a sweet domestic segment in Canada’s sugar supply

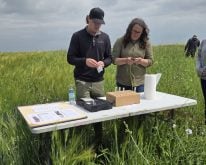

The sugar beet industry is showcased during a Farm to Table tour, as Taber features the last remaining sugar beet processing plant in all of Canada.