SAN FRANCISCO, Calif. (Reuters) — A number of leading economists, including advisers to past U.S. presidents, have coalesced around the view that president-elect Donald Trump’s plans to broaden tariffs, cut taxes and curb immigration may not prove as inflationary as early analysis had suggested.

At the same time, these economists said, any effort by Trump to exert control over the Federal Reserve would pose a real risk of reigniting price pressures, vexation with which helped get him elected.

With less than two weeks to go before Trump’s inauguration, the uncertainty about what his second stint in the White House will mean for the U.S. economy was a central focus of discussion last weekend at the American Economic Association conference in San Francisco, one of the premier annual gatherings of leading economists.

Read Also

Farmland advisory committee created in Saskatchewan

The Saskatchewan government has created the Farm Land Ownership Advisory Committee to address farmer concerns and gain feedback about the issues.

Trump will inherit an economy growing at a brisk pace of around three percent, even as inflation has come down significantly from its peak, with the unemployment rate at a historically low 4.2 per cent.

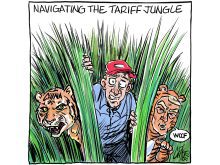

His economic agenda includes stiff tariffs, not just on China but on Mexico, Canada and the European Union, which could lift prices of imported goods. He also aims to extend expiring tax cuts and possibly offer new tax breaks that could stoke demand just as the Fed is aiming to cool it.

An immigration crackdown could dent the primary source of U.S. labour force growth, which some fear could fuel wage inflation.

Nevertheless, former Fed chair Ben Bernanke told the gathering that “Trump policies, whatever their merits on public finance grounds, probably will be modest in terms of their effect on the inflation rate.”

Most of the expiring tax cuts were expected to be kept in place no matter which presidential candidate was elected, Bernanke and others point out, and congressional appetite for additional cuts against the backdrop of rising national debt may be limited.

Bernanke, an adviser to former president George W. Bush’s administration before leading the Fed, said that while immigration curbs might push up wages, they also mean fewer people buying goods and services, which could ease price pressures.

And although the effect of tariffs “is very hard to forecast because we don’t know if the president wants to just put them on temporarily for bargaining purposes or whether he wants to keep them permanently,” said Bernanke, “barring some very unusual situation, including perhaps political risks, it doesn’t seem like that’s going to really shift the inflation path radically.”

Some advisers to previous Democratic administrations shared Bernanke’s sanguine view.

Christina Romer, an economics professor at the University of California, Berkeley, and adviser in former president Barack Obama’s administration, offered a similar analysis: “In terms of the overall macro economy … you won’t see a drastic change or things that are terribly frightening.”

Still, she said, there are risks. Trump, for instance, could try to interfere with Fed chair Jerome Powell’s attempts to bring inflation to heel.

“If there were an attack on Fed independence, I think it would be very consequential,” said Romer, though the potential that doing so would undermine confidence and send financial markets into a tailspin makes the scenario unlikely in her view.

Jason Furman, a Harvard economics professor who also advised Obama, expressed a bit more worry, noting that even if Trump gains little sway over Fed policy over the next four years, he could pave the way for a successor to use partisan nominations or other means to chip away at Fed independence.

And while he said he agreed that Trump’s policies would have a “relatively small” effect on inflation, he did make the point that even a few tenths of a percentage point on top of the current 2.4 per cent inflation rate could be enough to put Fed rate cuts on hold this year and even prompt some hikes next year if price pressures don’t abate.

Still, the current strength and momentum of the economy won’t easily be knocked off course, others noted.

Karen Dynan, a Harvard economics professor who worked in the Obama administration, told a panel at AEA that while Trump’s proposed tariffs and immigration crackdown could pose headwinds to growth or fuel inflation or both, consumer and business confidence has been strong, bolstered by the prospect of future Fed rate cuts as well as stock market gains.

Adding it all up, she said, “my own guess is there’s a good chance the economy’s going to remain on track, with this solid path forward and continued disinflation.”